How often do you assess the engagement and risk status for each of your customers? Especially the high priority customers. More often than not, a handful of customers contribute to a large portion of the total business revenue. What would be the impact of losing one or more of such customers? How could you avoid such a potential loss without an early risk assessment and timely intervention? Do you have a customer retention strategy?

As a business owner or manager, you need definite answers for the questions listed above. A lot of effort and resources are utilised in new customer acquisition. Customer retention and continuous growth in existing customer revenue share is necessary for optimising marketing ROI and building a stable revenue stream.

So, how can you assess the engagement and risk status of your customers? What should be your customer retention strategy?

A customer, especially someone who has been around for a while and with multiple decision makers in the B2B space, does not take an abrupt decision to end a business association. Abrupt and sudden cancellations are rare and triggered by a very serious mistake or error. Customers give subtle warning signals long before they decide to pull the plug.

These signals could be intentional or unintentional. These could be verbal or written. These could be expressed in a formal setting or could be a passing comment. Whatever the medium and place, it is important that you track and take notice of these subtle early warning signals.

What could be these early warning signals?

- Declining revenue trend: a continuous decline in sales revenue from a client is almost always a clear indicator of a potential risk of losing the customer. The decline could be due to multiple factors. Like entry of a new supplier or reduction in revenue for the client for that particular product or service. However, it does call for an investigation.

- Promoters and Detractors in the client organisation: If you have one or two key people in the client organisation who would vouch for your service quality and standards, they can bail you out of difficult situations and lend you a lifeline when needed the most. A detractor would do quite the opposite. Hence, keep a track of how many promoters and detractors you can count. I recommend maintaining a dossier for key people in every client organisation. It is business, however at the end it is always people for people or people against people.

- Complaints from the client: Be it verbal or written, never ever ignore a customer complaint. It may have come from the most insignificant client employee, however these count when important decisions are to be taken. Keep a track of the complaints. Let the client know what steps have been taken to address the issue.

- Appreciation from the client: You cannot count the client as a promoter if you have never been genuinely appreciated for your contributions and service. No appreciation and more complaints is a risky territory.

- Payment status: Has the client been irregular with the payments or most bills have been outstanding in the last few months? If the client was on time with payments earlier but has started paying bills late now, it is a matter of concern.

- Responsiveness: Similar to payments, if the client’s response to emails, calls, meeting requests, suggestions has started to be irregular, it is a matter of concern. It indicates that your priority as a supplier or partner is not the same. Hence, a potential risk to business.

These are few of many indications and early warning signals a client may give before they finally decided to end the business association. Start tracking and monitoring these as a part of your customer retention strategy.

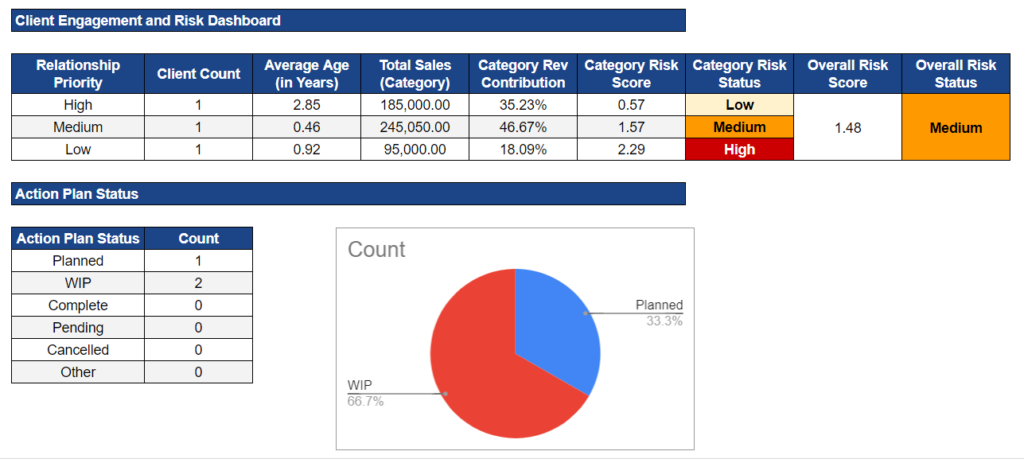

FREE Template - Client Engagement and Risk Tracker Download this easy to use template to track the early warning signals and monitor the risk status for each of your clients.